Forex trading gives everyone opportunity to participate in the trading markets. Robinhood has grown in prominence as a platform for trading many financial assets, including forex, due to its user-friendly interface and commission-free setup.

Robinhood is an online investing platform that provides free stock, options, EFTs, crytocurrency trades, and commission-free trading on several US investment types. Robinhood was the first major brokerage platform to eliminate commissions on stock and options trading, helping to revolutionize the industry. Its account minimum is $0.

In this comprehensive we will be putting you through on a step by step process of trading Forex on Robinhood.

1. Understanding and Knowing About Forex Trading

Before diving into trading Forex on Robinhood, it is crucial to first of all grasp the basic concepts of Forex. Forex trading involves the buying and selling of currencies, aiming to profit from the fluctuations in exchange rates. Traders take analysis on currency pairs, such as EUR/USD or GBP/JPY, by predicting whether a currency will appreciate or depreciate against another.

Knowledge is the foundation of successful trading. Before you trade, start by educating yourself about fundamental and technical analysis, market indicators, and economic factors that affect currency prices. Research and stay updated with the latest news and economic events that determine currency markets.

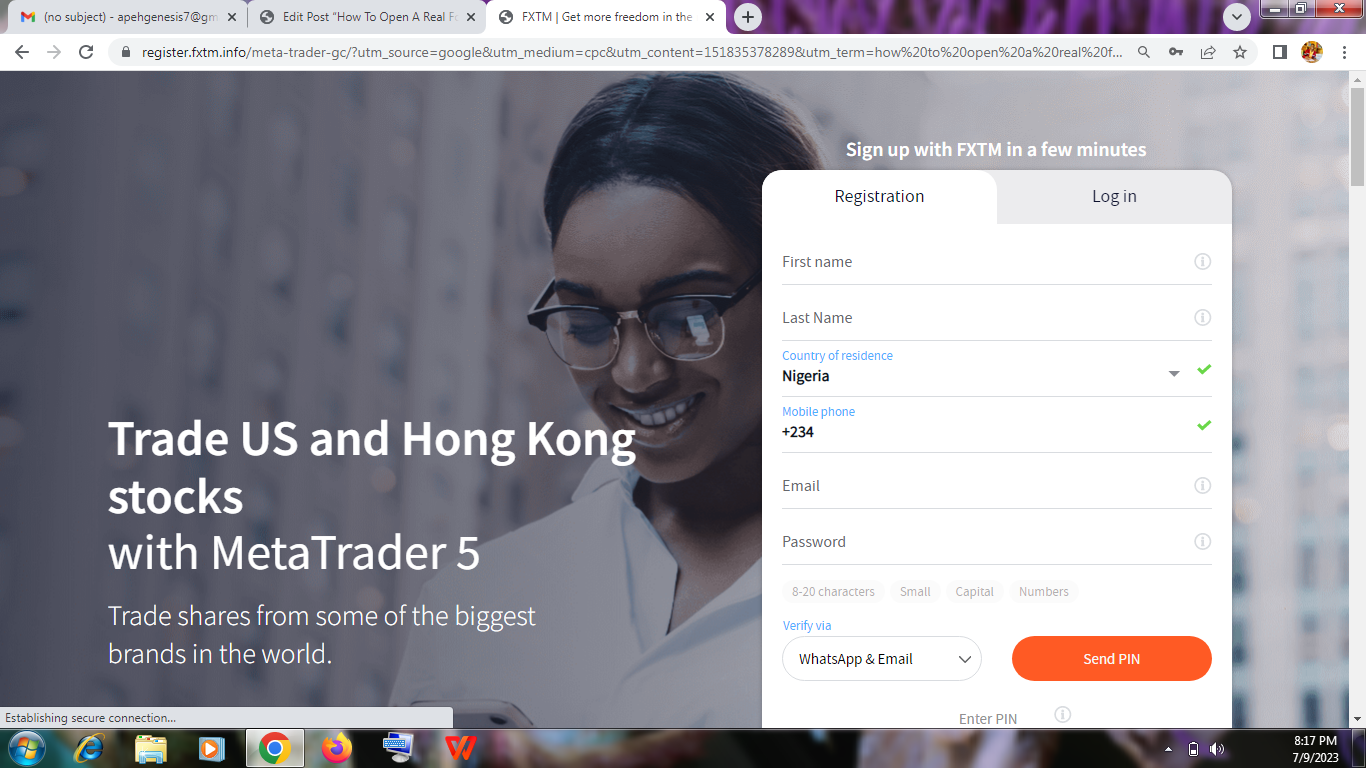

2. Open An Account With Robinhood

Robinhood is primarily known for its stock trading capabilities and it offers a limited selection of Forex pairs.

To start trading Forex on Robinhood, you must open an account with the platform. The process is concise and it can be done in a few minutes. Download the Robinhood app from your browser or Google Play Store (if you are using your phone) and create an account. In creating your account, you will need to provide your personal information, such as your name, address, and Social Security number. Ensure that you have completed the necessary verification process. Once you have verified your account, you can start trading.

It is important to understand access to forex trading on Robinhood is currently available to residents of the United States only.

3. Fund Your Account

To start trading forex on Robinhood, you must fund your account. This can be done through bank transfers and debit cards. You can transfer funds from your bank account or use your debit card to deposit money into your Robinhood account. After funding your account, you can start trading.

4. Choose The Currency Pair You Want To Trade

The next step is to choose the currency pair you want to trade. Forex trading involves buying and selling currency pairs. Take time to understand each currency pair’s characteristics, liquidity, and price movements. For example, if you think the value of the euro will increase compared to the US dollar, you can buy the EUR/USD currency pair. On the other hand, if you believe the value of the euro will decrease, you can sell the EUR/USD currency pair. Major currency pairs, such as EUR/USD, USD/JPY, GBP/USD, and USD/CHF, tend to have higher liquidity and tighter spread.

5. Place Your Trade

Once you have selected the currency pair you want to trade, you can place your trade.

Utilize technical analysis tools to identify potential trading opportunities. Robinhood offers a variety of charting tools and indicators to assist with technical analysis. Use popular indicators such as moving averages, Bollinger Bands, MACD, and RSI to identify trends, support and resistance levels, and potential reversal patterns. Robinhood offers a user-friendly interface that makes it easy to place trades. To place a trade, select the currency pair you want to trade and enter the amount you want to invest. You can also set stop-loss and take-profit orders (TP1, TP2) to limit your losses and place your profits on guard.

6. Monitor Your Trade

After you have placed your trade, you need to monitor it. Forex trading has a volatile marketing structure, and its prices can change rapidly. You can monitor your trade on the Robinhood app and make adjustments as needed.

Monitoring a trade can also come in the form of taking analysis on the market structure (even before you place your trade). Taking fundamental and technical analysis best explain this. Technical analysis involves utilizing technical analysis tools to identify potential trading opportunities. Robinhood provides many charting tools and indicators to assist with technical analysis. Using popular indicators such as moving averages, Bollinger Bands, MACD, and RSI assist in identifying trends, support and resistance levels, and potential reversal patterns. Moreover, taking fundamental analysis involves staying informed about economic news and events that affect currency markets. Robinhood has a news feed and economic calendar which will help you to stay informed and track important announcements. Develop an understanding of how economic indicators, central bank decisions, and geopolitical events can determine currency prices.

Conclusion

Forex trading on Robinhood is an excellent way to make money online if you reside in America. The platform offers a user-friendly interface, and a commission-free trading. To trade forex on Robinhood, you need to open an account, fund it, and choose the currency pair you want to trade, place your trade, and monitor it. With the right strategies, you can make consistent profits from forex trading on Robinhood.

NB: check out our next upload on “how to trade forex on Webull”.