The appearance of altcoins was after a short while of Bitcoin creation. About 90% of the crypto market comprises of altcoins. However, there helped to create alternatives to other cryptocurrencies. Already, there are more than 6000 altcoins that are presently in circulation in the crypto market.

Well, making investments on altcoins attracts so many advantages as many come with a high yield of profits but analyzing from the other hand, altcoins investments are most times risky if when compared to the major cryptocurrency Bitcoin. Early investors on altcoins are mostly at good ends sometimes, though this theory doesn’t work always as bad developers can easily rug pulled the project which causes great loss to investors.

Sometimes, buying or investing in altcoins is not the end of the journey but the most important thing is how to manage your portfolio, diversify and make good investment decisions. In this article, we will be considering what altcoins are all about, a few examples of altcoins, the benefits of investing in them, and how to diversify your portfolio to make good investments in altcoins.

What is altcoin?

Firstly, altcoin is an acronym for “alternative coin”. Altcoins are coins outside Bitcoin, that’s there are coins that was created after the invention Bitcoin. Some examples of those coins are; Ethereum, Litcoin, Xrp, Arpa, Dogecoin etc.

After the invention of Bitcoin in 2009, several developers have been launching many kinds of cryptocurrencies into the crypto space. Till present other altcoins keep rolling into the industry ranging to shit and memecoins. Many of these alternative coins are deviating from the mechanism at which Bitcoin was built on and introducing different kinds of features such as; their total supply, possession of smart contracts like Ethereum, their security measures etc.

Although, the features posed by some of these altcoins gave them valuable utilities that attracts investors to invest on them.

Examples of alternative coins:

Ethereum (ETH):

this is the second largest cryptocurrency by market capitalization after Bitcoin and it is the largest altcoin. The risk of investing on Ethereum is low when compare with other altcoins because of it price stability and it always moves with Bitcoin. Ethereum is the first altcoin that uses smart contracts, it gives user ability to borrow or lend, trade and so on. Bringing comprising between Ethereum and Bitcoin, it doesn’t permit most of these things because of the mechanism which it was built on.

Litcoin (LTC):

it has a total supply of 84 million, based on scrypt algorithm it uses proof of work consensus mechanism. LItcoin decentralization governance is through open-source and forking. It is often considered to be Bitcoin silver gold. Litcoin was built to have a similar use case as Bitcoin by making head to be use as a medium of exchange attempting to make transactions easier and faster, and also to be store as digital value.

Fantom (FTM):

The creation of fantom is to help for the provision of compatibility between all the transaction entities in the world. Also, to help in the creation of an ecosystem that allows the sharing of data and hasten transactions in real life.

ARPA:

Based on MPC, arpa is the first word privacy-preserving computation network. It enables private smart contracts on blockchain acting as layer 2. It helps in providing secure data transferring and sharing.

Benefits Of Investing In Altcoins

Other than Bitcoin, investing in altcoins comes with a lot of benefits as it always brings about possibilities of high interest return at a duration of a particular time. In this section, we will be looking at some of the benefits of investing on altcoins. These includes;

Technology Ideology: Most of the use cases that is been adopted by several altcoins are technologically based innovative ideal. When you invest on any of this alternative coin with such innovative idea, you are indirectly contributing to the development of the project. Alternatively, if there is mass adoption of such project based on this ideology, you being an early investor have higher benefits of percentage return profits. Examples of such innovative ideas are; smart contracts adoption, decentralized finance, non-fungible token etc.

High Profits Percentage Return: At the early stage of most altcoins, they are cheap and very easy to afford. But as time goes on, when many investors come in investing leading to rise in the price of the coin as well as the price of the market capitalization, you being an early investor will in turn have lots of benefits via a high percentage return from your early investment. For example, an investor who invested in Ether in 2015 had a higher percentage return than an investor who invested in 2022 because the prices had moved on different ranges since 2015.

Liquidity: Altcoins provides much liquidly at different crypto platforms that there are been traded hence help in easy buying and selling of altcoins.

Accessibility: Many altcoins are more accessible and have a cheaper price when compared to Bitcoin. Due to the wide availabilities and easy accessibilities of altcoins, investors can choose from any of these coins that perform different functions and with the best price in the crypto space to invest on.

How To Diversify Your Cryptocurrency Portfolio

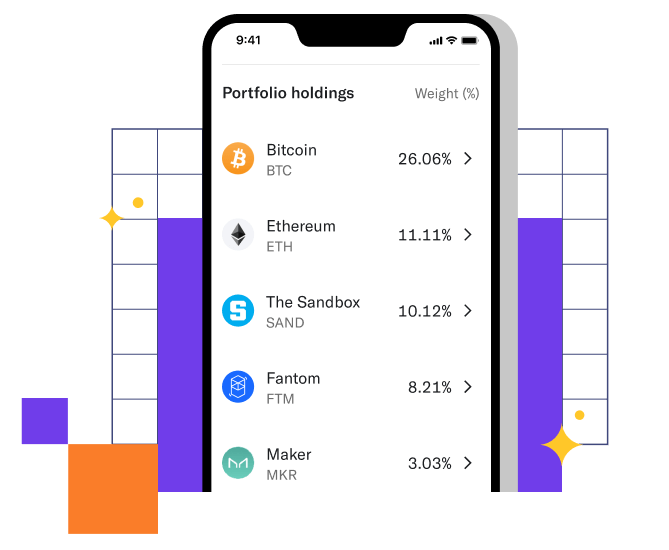

A well balanced diversified cryptowallet. source: pixel.com

One of the safeties measures to reduce the high risks of loss while investing in altcoins or in any other cryptocurrency is by diversifying your investment. This is the process by which your investments are been made on different crypto projects in other to reduce loss on those digital assets. Whiles diversifying your crypto investments, it is important to invest on projects with real life use cases in terms of technological ideology, financial ideology, gaming industry, blockchain, arts etc.

In addition, while diversifying your crypto investment it is important to consider the project market capitalization, the utilities, stablecoin that is pegged with if there is any. Those are the things to look up to.

Summary

Altcoins means “alternative coins”. It is the term given to coins that was created after the invention of Bitcoin. In the crypto ecosystem, there are over 6000+ altcoins with different use cases. Examples of some of those altcoins are; ETH, LTC, XRP, GTC ETC.

Making investments on altcoins comes with various benefits which includes; high profits percentage return, liquidity, accessibility etc. In diversifying your altcoin or crypto investments you put certain things into consideration in other to reduce the risks of future loss of your investments.